Billdget app

Background

In today's world, almost everyone is beginning to pay attention to all aspects of health. We spent nearly a month experimenting with five different health tracking apps. Financial health apps are helping people manage and increase the dollars and cents in their lives, intellectual health apps are helping people learn and grow in creativity and wisdom, relational apps are helping people connect in a more meaningful and mutually beneficial manner, spiritual health apps are helping people form, maintain and accomplish a sense of meaning and purpose, and physical health apps are helping people manage and improve their physical bodies as well as their time. After using various types of apps for a week, we decided to choose financial health apps as the theme of the project.

Role

The whole individual project is going to use UX thinking, research, and human-centered design techniques to create a financial health app that enriches users’ habits on financial management and has fun with our gamification experience. We are going to make users' habits healthier. Users can be aware of their daily habits to self-adjust their future schedules so that they can gradually develop better health.

Business Goal

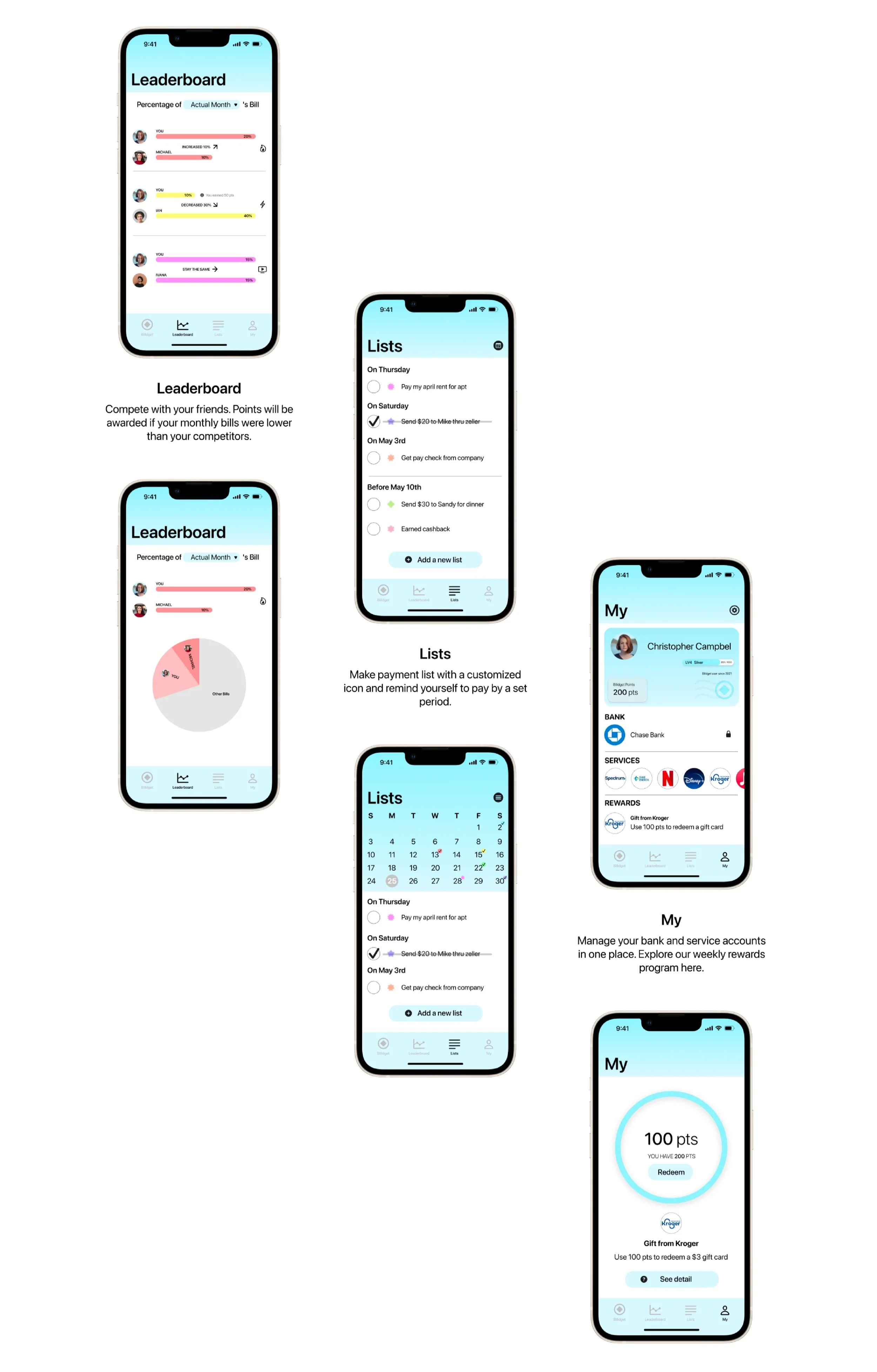

Leading users to easily check and control their monthly bills on a single page

Being essential home for users to see the highlights of all monthly bills' details in a pie chart or line chart view.

Keeping in touch with users to make sure they can pay their bills on time.

Helping users to improve their financial health habits.

Research

Gain an understanding of why users do or don’t do on the financial health apps.

Discover the pain points or poor UX of using financial health apps or features.

Explore current users' outlooks on future financial health app functionality.

Recognize must-have components of financial health apps through academic articles.

Research Goal

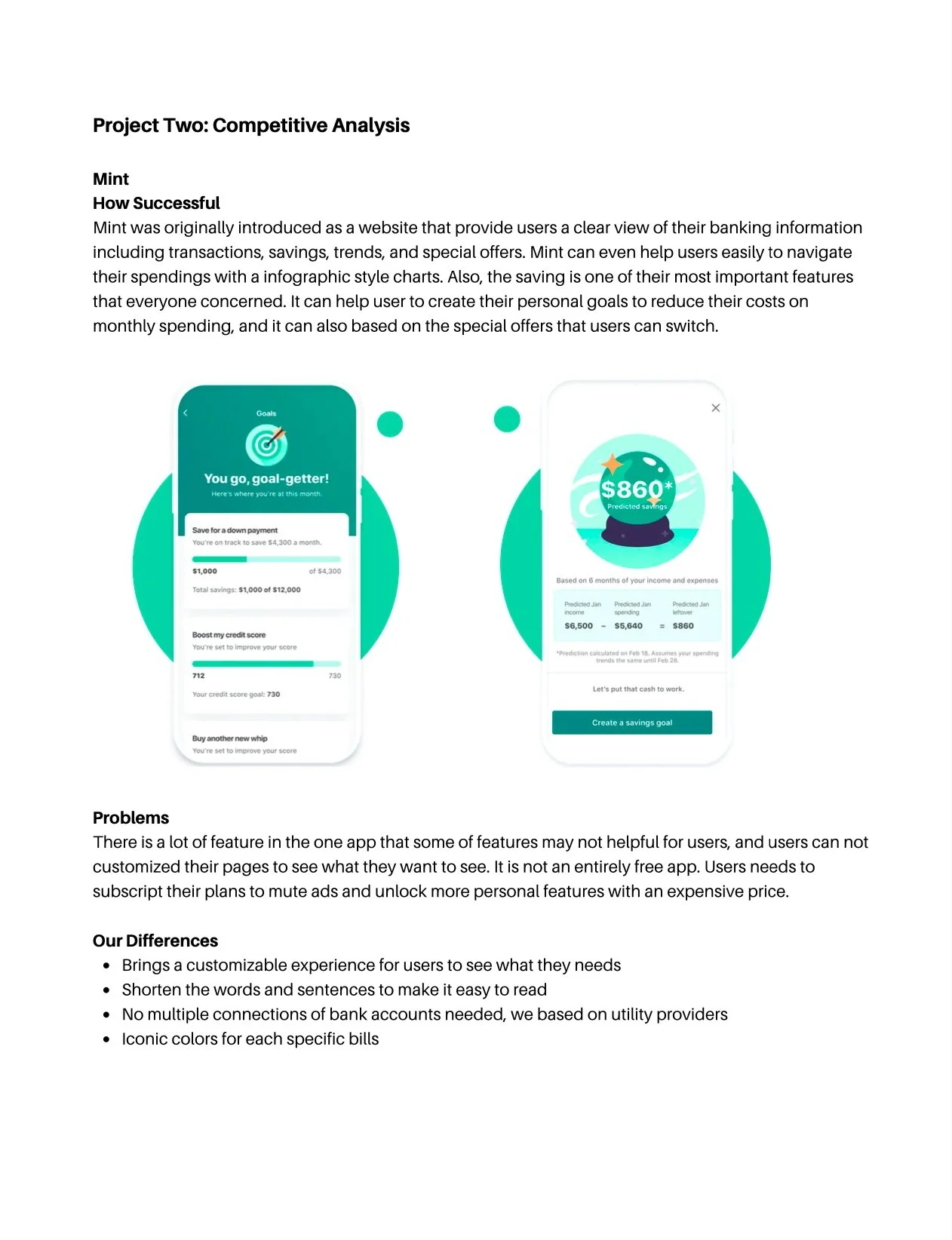

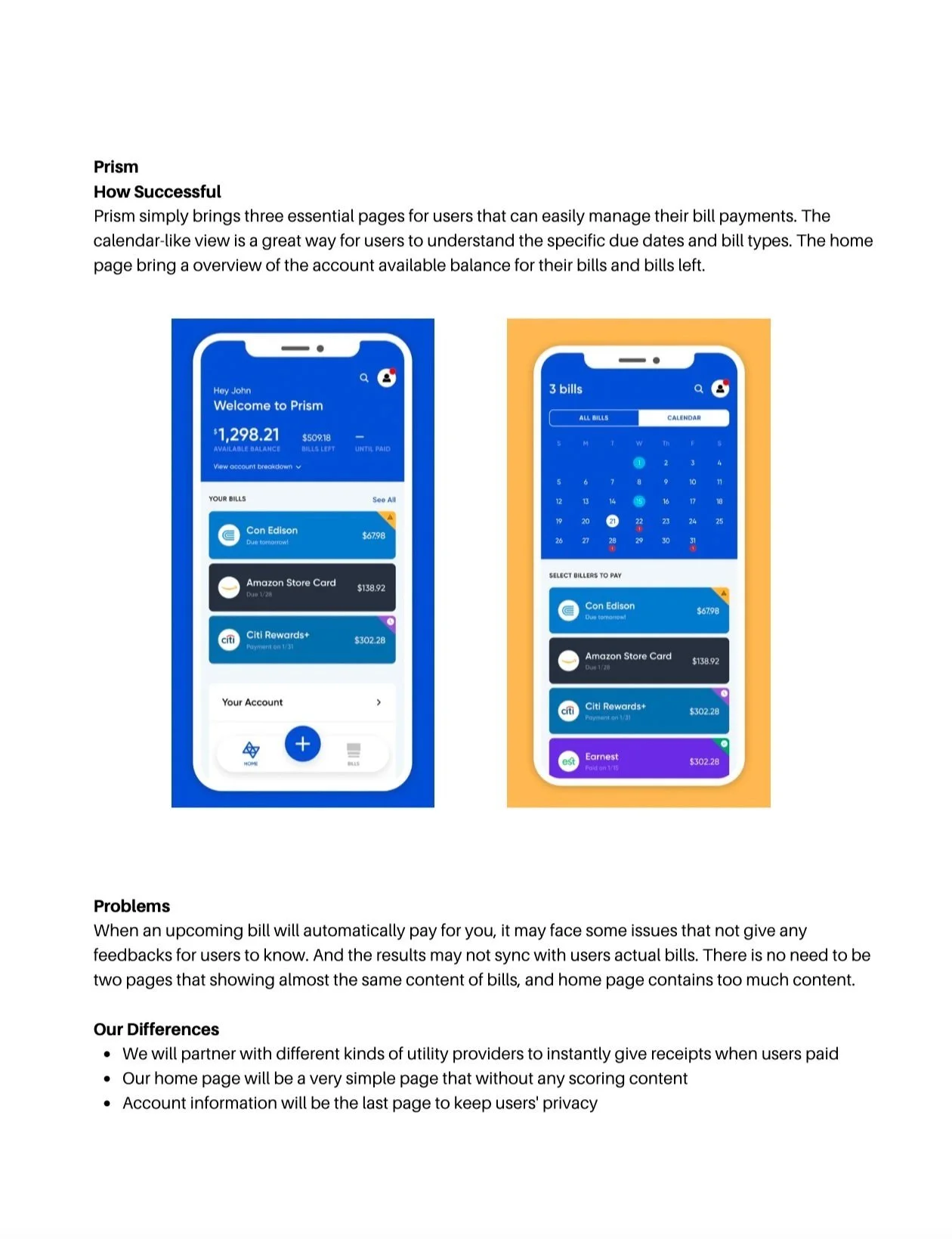

Our initial research was doing a competitive analysis with three different financial health apps. Plus, we have secondary research was a literature review. We searched different academic articles about financial health-related measurements and how financial health is important for people to enrich their lives. Finally, we are interviewing three people who "orbit around" the interviewer's personal profile. Then, the researcher synthesized the findings and notes. The session took anywhere from five to ten minutes for each participant. Video and audio were recorded. Participant videos or onscreen interactions can be recorded for this research with approval.

Research Method

We developed the three main topics of questions for the interviewees based on our research goals and resources. The first topic is background questions which briefly obtain information from interviewees about their using habits and thoughts. The second topic is detailed questions, and we ask questions about users’ needs and wants. The last topic is follow-up questions which are based on previous questions we asked to bring the topic even further.

Questions

Both the results of interviews and research resources gave us an impressive experience about how financial health work. The testers gave us a lot of great ideas on the tracking process, such as the refund and the overcharge detail. She hopes there is one app that can figure out all needs to pay the utility bills and rent in an easier way. We also talked about issues about how we could make the app in one place including the monthly budget which is the most important thing that some people really care about. Also, we learned about the four components of financial health for most people's daily financial activities: spending, saving, borrowing, and planning. Thus, it can be recognized and understood that most of the current needs and how people manage their expenses to keep fit in financial health. At the same time, the whole article also uses other perspectives to observe how people's physical health and mental health will be affected starting from financial health.

Research Findings

People Problem

Not every people have habits of controlling their financial health. One of the problems with these apps is too informative and repetitious which means they are hard to pick one to get to use. People love entertainment and they prefer an easier and funnier challenge way to enrich their daily life. Another problem is some unnecessary psychological problems sometimes entrusted to the user. The content and amounts are too prominent to avoid some avoidable pressure on users.

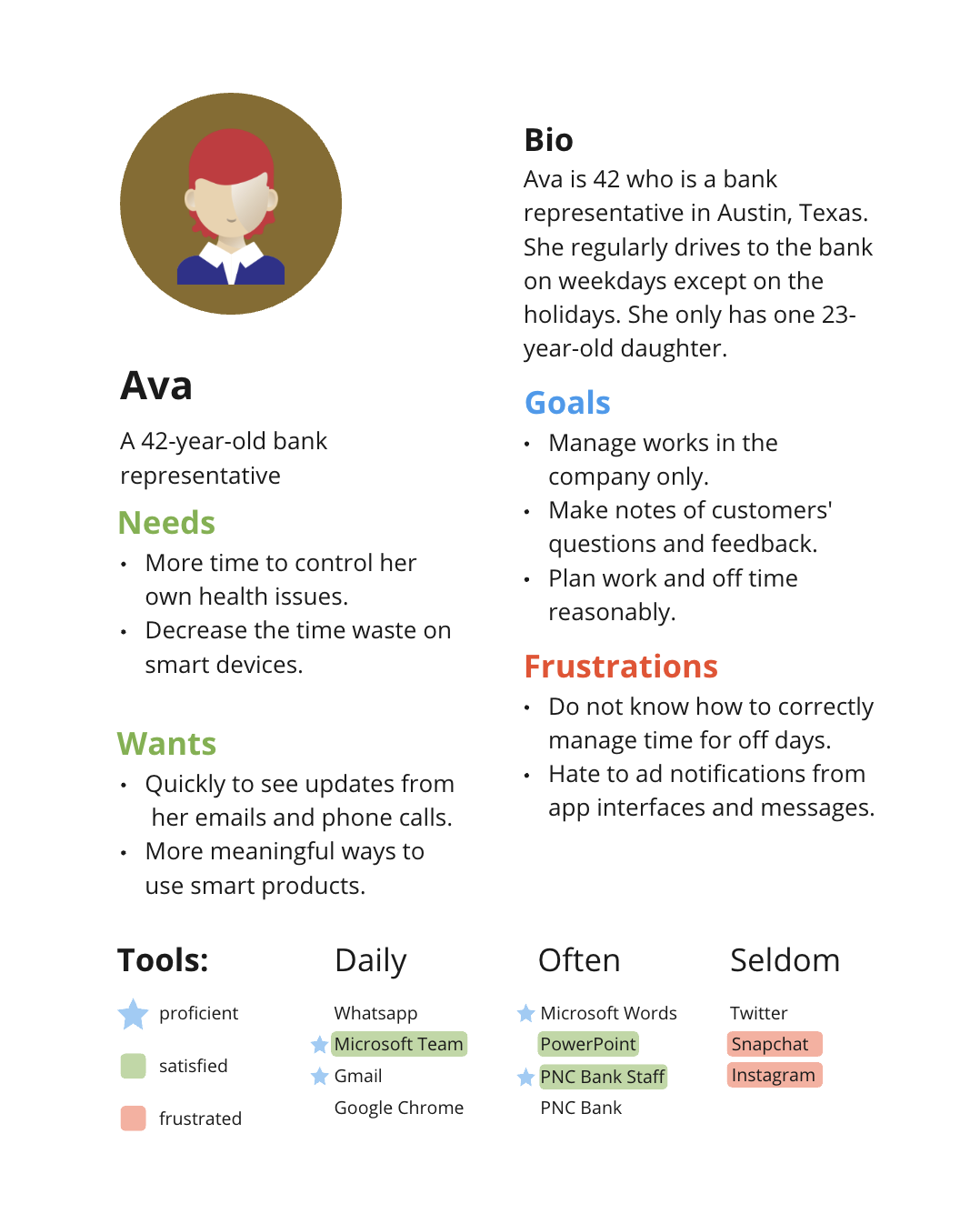

Persona

Journey Map

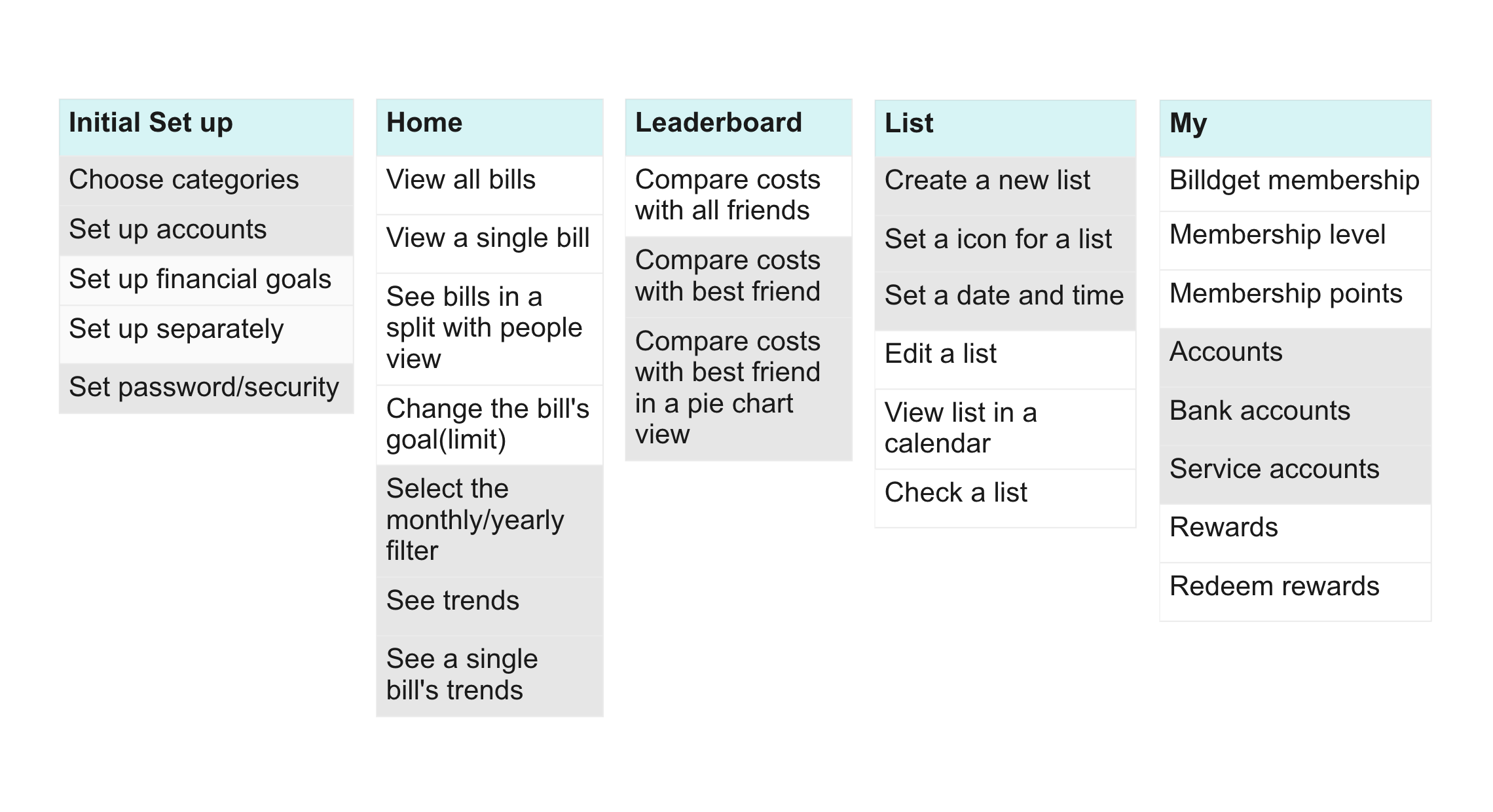

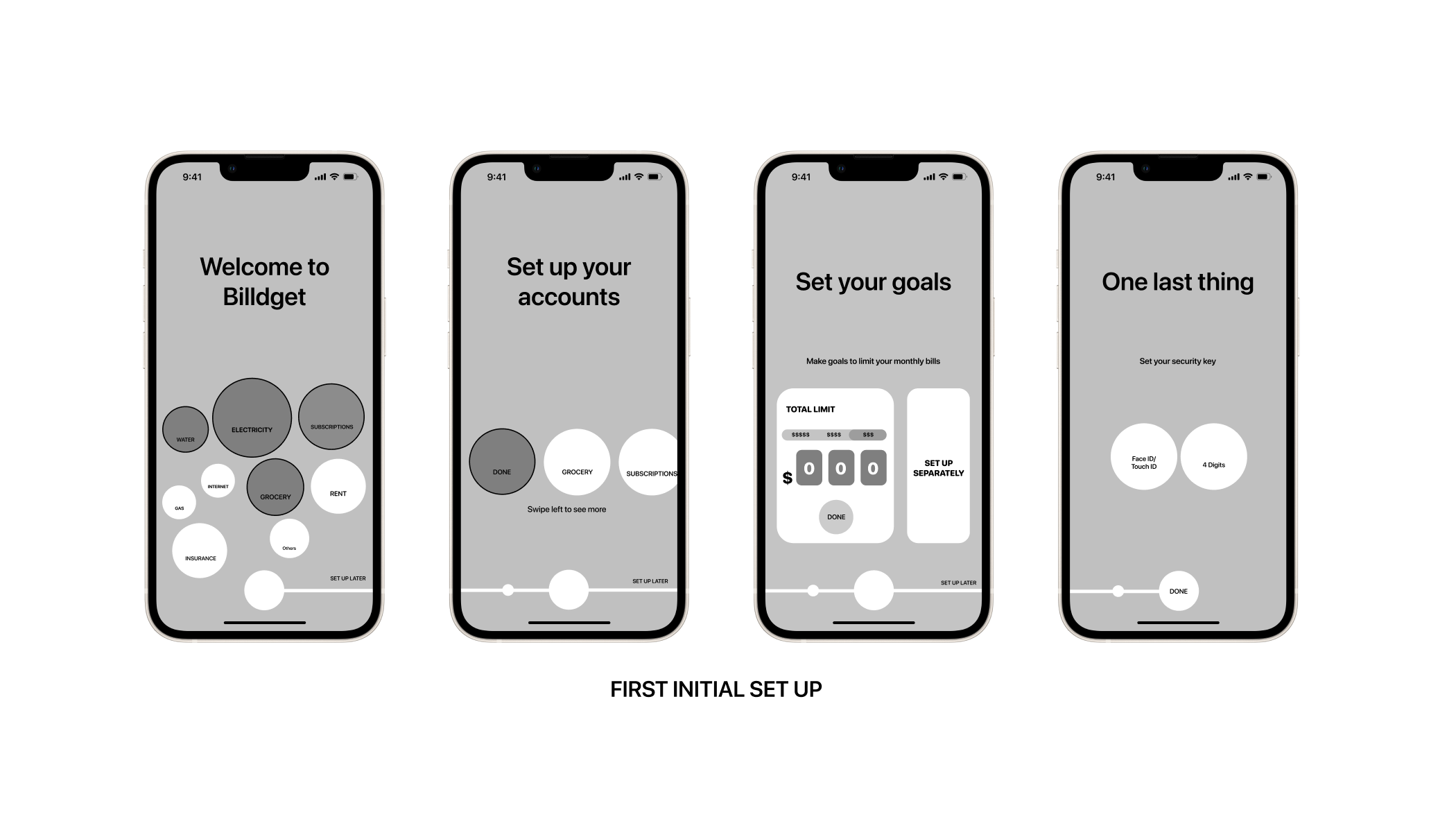

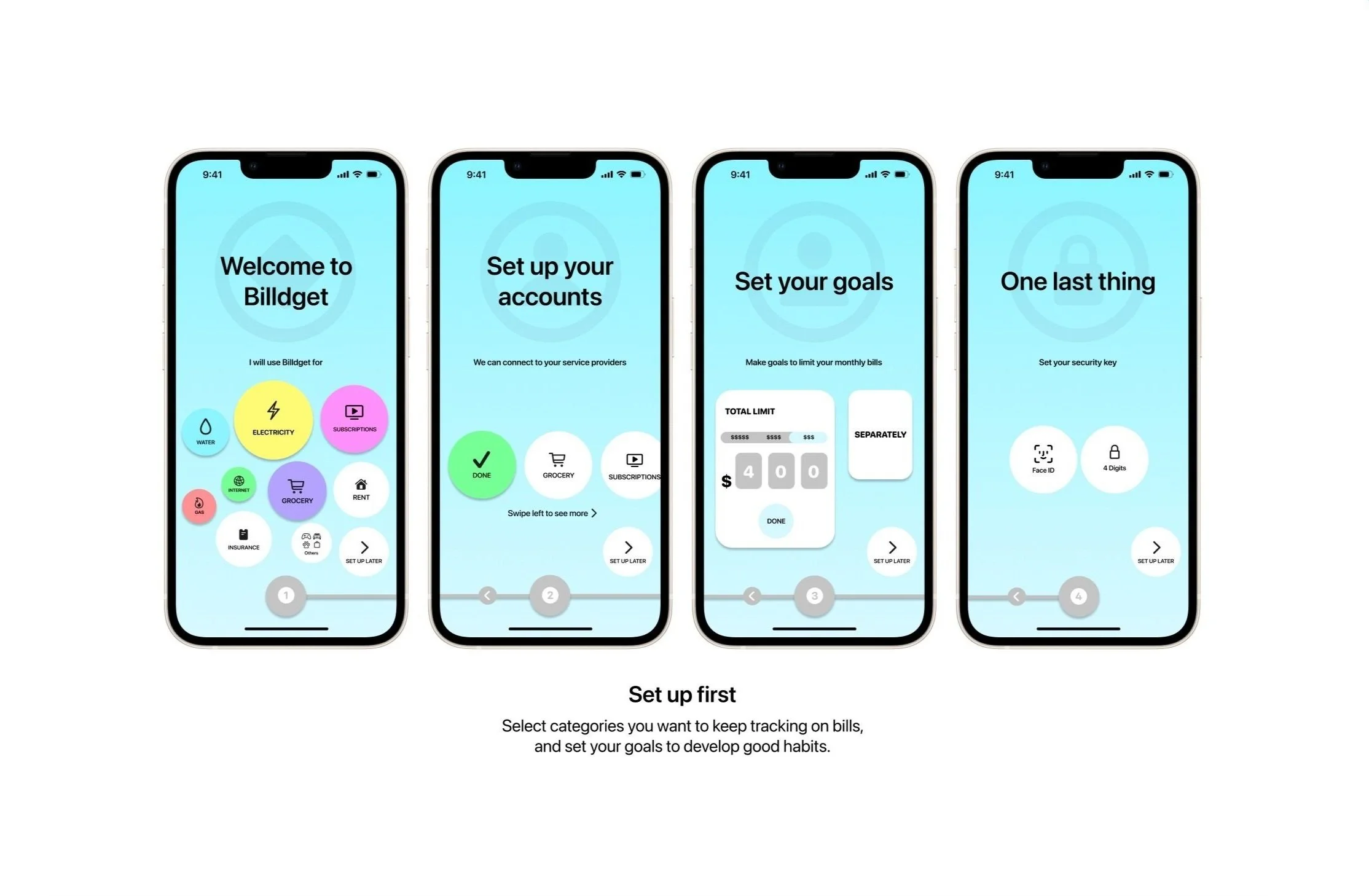

Workflow

Before

After